Northway Bank debit card provides a safe, quick and convenient way to access your money.

Debit Card

Debit Card controls

Report a Lost or Stolen Debit Card

Apple Pay

Go to Apple Pay

Samsung Pay

GOOGLE PAY

Debit Card

Debit Card Features

- Make purchases directly from your checking account without the need to use cash or write a check

- Make purchases anywhere Mastercard® is accepted

- Zero liability - your purchases are covered by Mastercard's zero-liability policy (conditions and exceptions apply)

- Use your debit card as an ATM card at any Northway Bank, NYCE, or Mastercard network ATM3 to make withdrawals, balance inquiries, and transfers between your linked accounts

- Get cash back when making a purchase at a merchant point-of-sale terminal

- Through Mastercard, your debit card is token-enabled - meaning your card credentials can be stored with participating merchants without exposing your card number and expiration date. This is particularly convenient and more secure for online purchases and recurring transactions (i.e., a Netflix subscription).

- Mastercard Guide to Benefits (Consumer) PDF 592KB

How can I get a new or replacement debit card?

- Printed in minutes at any of our branches; no more waiting for a new card to arrive in the mail

- Easy, quick, safe, and secure

- Immediate activation and access to funds

- Come in to any branch

- Go to "Preferences" and select "Manage Cards"

- Choose the card you'd like to replace and choose "Card Options"

- "Reorder Card"

Digital Wallet User

Travel Tips with your debit card

- Alert us when traveling out of state and abroad

- We constantly monitor transactions for suspicious activity. If we know you're traveling out of the area, we can ensure your transactions will not be declined

- You can place a travel alert by calling us at 800-442-6666 or visiting your local branch

- Treat your card as you would treat your credit cards, checkbook, or cash

- Never reveal your Personal Identification Number (PIN) to anyone

- Use our Online and Mobile Banking services to stay on top of account information and set up account alerts

- If your card is lost or stolen while you travel, notify us immediately by calling 800-442-6666

- Remember, your purchases are covered by Mastercard's zero-liability policy (conditions and exceptions apply)

credit or debit?

- Whether you sign or use your PIN, the payment is still taken directly from your checking account

- With PIN-based transactions, the payment amount is immediately deducted from your checking account

- With signature-based transactions, the payment amount is run similar to a credit card transaction and can take up to 2-3 days to fully hit your checking account

- We recommend customers choose "credit" and sign for transactions. Peak and True Rewards Checking account holders can earn $0.10 with Dime-a-Time every time you use your debit card and choose "credit"

Protecting Yourself From Card Skimming

Take a close look at every card machine and ATM, looking for signs of tinkering, such as a too-thick keypad, an odd-colored card slot, or misaligned graphics. At gas pumps, look for a security seal.

Visit merchants that you know and trust and visit stores where the point-of-sale terminal is located next to the clerk. Keep an eye on your card at all times. Before inserting or swiping your card, look for anything odd, damaged, or loose. And if it’s difficult to insert your card, don’t use the terminal. When using your card at gas pumps, run your card as credit instead of debit to reduce the risk of having your PIN stolen.

Some crooks are placing cameras at point-of-sale terminals that can record your PIN as you enter it. Shield the keypad when entering your PIN, and secure your card and cash before exiting stores, banks, and ATMs. Always be aware of your surroundings.

Remember, if your card is skimmed, you’re covered by Mastercard’s Zero Liability (conditions and exceptions apply).

Mastercard Automatic Billing Updater

Q: What are the benefits of Mastercard Automatic Billing Updater?

A:

- Helps to ensure your recurring payments are on-time

- Uninterrupted service from card-on-file merchants

- Reduces likelihood for customer service interruptions with billing disputes

- Less hassle if your card is ever reissued, lost or stolen

A: These are regular payments you’ve set up with a merchant or service provider. These merchants store their customers’ card number information for recurring payments. Some examples include:

- Utilities

- Cell phone service

- Cable service

- Gym membership

- Music subscriptions

A: No. Mastercard Automatic Billing Updater is only available to participating merchants. At their discretion, these participating merchants can choose the frequency at which they try to obtain updated cardholder information prior to their billing cycle.

A: There is no fee for this service and all Northway Bank debit cards will be automatically enrolled unless you decide to opt-out.

Q: Can I decline the Mastercard Automatic Billing Updater service?

A: You can request to opt-out of this service by completing our Mastercard Automatic Billing Updater Opt-Out Form. You can also visit any Northway branch or call us at 800-442-6666. Keep in mind that your automatic payments will be declined and merchants may charge you a late fee if your card information is not up to date.

Q: If I decide to decline the Mastercard Automatic Billing Updater service, can I opt back in if I change my mind?

A: Yes. Please call us at 800-442-6666 or visit a branch to opt back in.

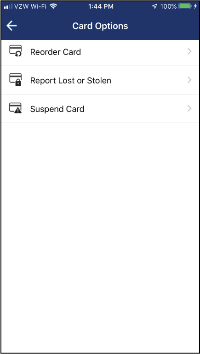

Debit Card Controls

basic features within online & mobile banking

- Every Northway Bank debit card is equipped with an EMV chip and the enhanced transaction security that comes with that technology

- Transactions monitored for fraud activity 24/7

- Through Mastercard, your debit card is token-enabled - meaning your card credentials can be stored with participating merchants without exposing your card number and expiration date. This is particularly convenient and more secure for online purchases and recurring transactions

- Gain insight and control over your spending by setting customized transaction parameters for your debit card

- Use your Northway Bank mobile app or online banking to reorder, report a card lost or stolen, or activate a new card received in the mail:

| 1 | Once you've opened the Northway Bank mobile banking app, tap on the hamburger menu  then select "Accounts". then select "Accounts". |

|

| 2 | Select the account that your card is connected to. |  |

| 3 | Select "Card management". |  |

| 4 | Choose the desired Card service. If you simply want to turn your card off temporarily, select the toggle button to the right of the card detail. |  |

Advanced mobile banking only features

- Turn your card on or off with a simple tap of your finger

- View all recent and pending debit card transactions

- Set your card transaction limit

- Create debit card transaction alerts

- Control the location of where and how your debit card can be used

- Enroll each of your Northway Bank debit cards

- And more

simple setup

- Card controls are already built into our mobile banking app. Just follow these simple steps to customize your own controls:

| 1 |

Once you've opened the Northway Bank mobile banking app, tap on the hamburger menu

then select "Accounts", then select the account that your card is connected to. then select "Accounts", then select the account that your card is connected to. |

|

| 2 |

Select ”Card management".

|

|

| 3 |

Select "Alerts and protections".

|

|

| 4 |

Manage your Notification settings. You have 3 options for how you can receive a notification on a transaction. An In-app message, email, or text.

You will only receive notifications for the Protection options you have selected. Set your Protection options. Choose to block and/or be notified on a transaction based on Location, Merchant types, Transaction types, and Spending limits. Be sure to tap the 'Save' button to ensure your preferences are captured. |

|

FAQs

A: Debit Card Controls are easy-to-use features within our mobile banking app that lets you set debit card controls, add restrictions, and receive transaction alerts.

A: Just follow the Simple Setup instructions above. Then you can set a wide range of controls and alerts on all your debit cards. For example, you can:

- Turn your debit card on or off

- Set transaction spending limits based on your preferences, including dollar amount, transaction type and merchant type

- Get instant alerts on certain types of transactions, like when a transaction is declined

- Set a specific region where the debit card can be used or restrict usage based on your mobile device’s location

- Set parental controls and monitoring

A: Because you can manage your debit card transactions all in one place, right from your mobile device. You have complete control of how, when, and where your debit card is used.

Plus, knowing that you’ve set rules, restrictions and alerts that meet your specific spending preferences adds another layer of fraud detection and prevention, and gives you added peace of mind.

A: Yes, managing your debit cards is safe and secure. Your account is password protected and highly encrypted.

A: No, you cannot enroll your Northway Bank Credit card.

A: Yes, you can enroll and manage your Northway Bank ATM card.

A: All transactions, other than recurring transactions, will be denied.

A: Your phone’s location feature must be set to Allow. When My Location Preference is turned on in the mobile banking app, in-store transactions at locations that differ significantly from your location will be denied. The app can determine where the phone is at any time. An in-store debit card transaction at a location far away from you is likely fraudulent. Online transactions are exempt from this preference.

A: Call our Customer Service Center at 800-442-6666 and we will turn off your location preferences until your phone is found or replaced.

A: Yes, setting your location preference in the app doesn’t replace the need to let the bank know you will be traveling.

A: When you receive a new debit card, for any reason, you must update your debit card information in the app.

A: Simply open the Northway mobile banking app and turn off your debit card. If this is done quickly enough you may be able to stop the transaction. You should then call our Customer Service Center at 800-442-6666 and report the transaction.

Apple Pay Simple Set up

- Go to Settings

- Open Wallet & Apple Pay and then select "Add Credit or Debit Card" (You can also open the Wallet app directly)

- Use your device's camera to input your card information or enter it manually

- Call Northway Bank at 800-442-6666. We will verify your information and complete the setup

How Apple Pay Works

| Disclaimer | ||||

|---|---|---|---|---|

|

|

|||

Apple pay FAQs

A: With Apple Pay, you can easily pay for your purchases at participating merchants with virtual debit or credit cards on your iPhone, Apple Watch, or iPad. See the Apple site for a complete list of compatible devices.

Q: What security features come with Apple Pay?

A: With Apple Pay, every time you make a purchase, your unique Device Account Number along with a one-time security code are used to process the payment instead of your actual card number. Therefore, your actual card information is never shared with merchants or transmitted with payment. In addition, your physical card number is not stored on your phone, and only the fingerprints you associate with your Touch ID or phone passcode can authorize a payment.

Zero liability – as always, your debit card purchases are covered by Mastercard’s zero-liability policy (conditions and exceptions apply).

Q: Where can I use Apple Pay?

A: You can use Apple Pay at thousands of locations. You can also make purchases within participating apps. Look for these symbols at checkout:

- See a list of stores and apps

A: iPhone/iPad: On your iPhone, open the Wallet app. On your iPad, go to Settings > Wallet & Apple Pay. Tap Add Credit Card or Debit Card. If your Northway debit card is already on file with iTunes, enter the card’s security code. Otherwise, use the camera to capture the information on your Northway debit card. Fill in any additional information needed. Call Northway Bank at 800-442-6666. We will verify your information and complete the setup. After your card is verified, you can start using Apple Pay.

A: To change the default card, go to Settings > Wallet & Apple Pay. Tap Default Card, and choose your Northway debit card.

A: You can use Apple Pay to pay at participating merchants and within apps with compatible iPhones, iPads, the Apple Watch, and Macs. See the Apple site for a complete list of compatible devices.

Q: Does it cost anything to use Apple Pay?

A: There is no cost to Northway debit card users to use their card in Apple Pay. However, message and data charges may still apply from your wireless provider.

Q: What if I lose my device?

A: Your card information is not stored on your phone and only you can authenticate a transaction using Touch ID. However, as an additional security measure, please call the Customer Service Center at 800-442-6666 and we can remove your card from Apple Pay. Note that your plastic card is still valid to use. If your iPhone, iPad, or Apple Watch is ever lost or stolen, you can use Find My iPhone to quickly put your device in Lost Mode to suspend Apple Pay, or you can wipe your device clean completely. You can also stop the ability to make payments from credit and debit cards on your iPhone, iPad, or Apple Watch with iCloud. Just log into iCloud.com and click Settings.

Q: When my card expires or is replaced, do I have to enroll my new card?

A: Yes. When a new card is issued, even if it's the same number, it needs to be enrolled in Apple Pay. Your old card will also need to be removed. You can remove cards by going to Settings > Wallet & Apple Pay. Just select the card to delete and tap Remove Card.

Q: What cards are eligible?

A: Currently the following cards are eligible: consumer debit cards and business debit cards.

Q: How do I pay using my Apple Watch?

A: On Apple Watch, just double click the side button and hold the display of your Apple Watch up to the contactless reader.

Q: What is Touch ID?

A: Touch ID is Apple's biometric fingerprint authentication technology. With it, the Home button can unlock your iPhone and authorize your purchases within Apple Pay. For more information on the setup and use of Apple Pay, visit Apple Support.

Samsung pay simple set up

- Find the app pre-installed on your Samsung phone or download from the Google Play store

- Sign in to your Samsung account. Scan your fingerprint or iris and enter a pin to authenticate future purchases

- Snap a picture of your card and sign where necessary. Your card is securely backed up and can be restored with your Samsung account

How samsung Pay Works

- At store checkout, bring up your Northway card by swiping up from the bottom of your screen

- Select how you’d like to verify – biometrics or PIN. Hold near payment terminal

- If paying at a terminal for debit cards, tap near the magnetic stripe line where you would swipe a debt card. If it’s a tap-and-go terminal, simply tap your phone

samsung Pay FAQs

Q: What is Samsung Pay?

A: Samsung Pay is a digital wallet app that allows you to easily pay for purchases at participating merchants with virtual debit or credit cards on your Samsung device. See the Samsung Pay website to find out if your device is compatible.

Q: What security features come with Samsung Pay?

A: With Samsung Pay, each transaction is authenticated by your fingerprint, pin number or iris scan. Additionally, Samsung Knox tokenization adds an extra layer of security.

Zero liability – as always, your debit card purchases are covered by Mastercard’s zero-liability policy (conditions and exceptions apply).

Q: Where can I use Samsung Pay?

A: You can use Samsung Pay at thousands of locations, including in participating apps. Because Samsung Pay uses technology that replicates a magnetic strip from a debit/credit card, it can be used anywhere accepting traditional debit/credit cards. Samsung Pay can also be used anywhere a tap-and-go terminal is present.

Q: How do I add my Northway debit card to Samsung Pay?

A: To get started, add a credit or debit card by touching ADD in Samsung Pay. Touch Add credit or debit card and then follow the on-screen instructions to choose verification method, PIN for payments, and signature. Next, call Northway Bank at 800-442-6666. We will verify your information and complete the setup. After your card is verified, you can start using Samsung Pay.

Q: How do I make my Northway debit card the default card?

A: Samsung Pay does not have the option to set a default card. When you open Samsung Pay, the most recently used, viewed, or added card will display.

Q: Does it cost anything to use Samsung Pay?

A: There is no cost to Northway debit card users to use their card in Samsung Pay. However, message and data charges may still apply from your wireless provider.

Q: What if I lose my device?

A: Every transaction is authenticated by your fingerprint, pin number or iris scan. If your phone is lost or stolen, you can remotely lock or erase your Samsung Pay account with Find My Mobile. Contact Northway Customer Service Center at 800-442-6666 to remove your card from Samsung Pay.

Q: Which cards are eligible?

A: Currently, the following cards are eligible: consumer debit cards and business debit cards.google pay simple set up

- Download the Google Pay app in the Google Play store on your Android device

- Open the Google Pay app and follow the setup instructions

- If you have another payment app on your phone: make Google Pay the default payment app for easy access

how google pay works

|

google pay faqs

Q: What is Google Pay?

A: Google Pay is a digital wallet app that allows you to easily pay for purchases at participating merchants with virtual debit or credit cards on your Android device. See the Google Pay site to find out if your device is compatible.

Q: What security features come with Google Pay?

A: Every time you make a purchase, your unique device account number, along with a one-time security code are used to process the payment instead of your actual card number. Therefore, your actual card information is never shared with merchants or transmitted with payment.

Zero liability – as always, your debit card purchases are covered by Mastercard’s zero-liability policy (conditions and exceptions apply).

Q: Where can I use Google Pay?

A: You can use Google Pay at thousands of locations, including in participating apps. Look for the contactless symbols at checkout.

Q: How do I add my Northway debit card to Google Pay?

A: Open the Google Pay app and follow setup prompts. Add card number by using the camera to scan or enter manually. Google Pay will send a verification text or email to confirm your identity. Next, call Northway Bank at 800-442-6666. We will verify your information and complete the setup. After your card is verified, you can start using Google Pay.

Q: How do I make my Northway debit card the default card?

A: In the Google Pay app, tap Cards on the lower-right. Select your Northway debit card and tap Set as Default.

Q: Does it cost anything to use Google Pay?

A: There is no cost to Northway debit card users to use their card in Google Pay. However, message and data charges may still apply from your wireless provider.

Q: What if I lose my device?

A: Because your card information is not stored on your phone and your phone must be unlocked for nearly all payments, your payment information will stay safe. As a precaution, you may choose to lock or erase your phone using Android Device Manager; also contact Northway Customer Service Center at 800-442-6666 to remove your card from Google Pay.

Q: Which cards are eligible?

A: Currently, the following cards are eligible: consumer debit cards and business debit cards.Report a Lost or Stolen Debit Card

Northway Bank offers you the convenience of an instant issue debit card to replace your lost or stolen card.

If you’ve simply misplaced your card and want to secure it while you look for it, you can call Customer Service or use the mobile banking app to suspend your card.

reporting a lost card During Banking Hours

|

Customer Service

|

|

report, replace or suspend a card 24-Hours a Day

|

24 Hour Telephone Banking

|

|

|---|---|

|

Mobile App

|

|

|

Online Banking

|

|

3Owner of any non-Northway Bank ATM may charge a fee to use your debit card at their ATM.

Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay, Touch ID, and Apple Watch are trademarks of Apple Inc.

Customer Service 800-442-6666

24-Hour Telephone Banking 888-568-6310

NMLS #405698