Looking for simple and straightforward? Northway Bank is ready with Peak Checking.

If interest, rewards, and perks sound intriguing, True Rewards Checking and TrueNorth Relationship Checking are worth a look.

Peak Checking

True Rewards Checking

Earn interest on your balance of $1,000 or more. The monthly service fee is easy to avoid.

Go to True Rewards Checking

Go to True Rewards Checking

TrueNorth Relationship Checking

Our premium account. Earn interest on every dollar, avoid the monthly service fee with combined balances of $25,000, say goodbye to ATM fees, and get free checks.

Go to TrueNorth Relationship Checking

Go to TrueNorth Relationship Checking

Compare Accounts

Which checking account is right for you? Here's a handy chart to help you decide.

Go to Compare Accounts

Go to Compare Accounts

Reorder Checks

Need more checks? Order them online.Go to Reorder Checks

Locate our Routing Number

Northway's routing number is 011700425. Click if you're curious to learn more.

Go to Locate our Routing Number

Go to Locate our Routing Number

Checking Account Switch Support

These forms help you seamlessly transition your direct deposit and automatic payments to your Northway Bank checking account.

Peak checking Features

- No monthly service fee

- No minimum balance required

- Unlimited check writing

- eStatements required

At the time of account opening, you can elect to have any one of the following rewards at no cost to you if you perform 15 or more signature-based debit card transactions (posted and cleared) during each statement cycle:

- Debit card Dime-a-Time cash back1

- One fee-free non-Northway ATM withdrawal2 per monthly statement cycle

- One fee-free overdraft3 per year

- One free iTunes® download per monthly statement cycle4

1Earn $0.10 cash back for each signature-based debit card transaction paid on the last day of the statement cycle month in which the debit transaction occurs.

2ATM withdrawal made at any ATM in the U.S. that is not owned by Northway Bank. Fee assessed by ATM owner rebated within the statement cycle month of occurrence.

3The Overdraft Fee (item paid) per year will occur in the same statement cycle in which the corresponding overdraft occurs.

4Maximum value $1.29. Purchases must be made using your Northway Bank debit card to qualify, and must be made and posted in the statement cycle following the cycle in which the reward was earned. Reimbursement will be credited to your account within 60 days of your purchase. iTunes is a registered trademark of Apple Inc.

Convenient ways to access your Peak checking account

- Free Online Banking, Mobile Banking, and Bill Pay

- Northway Debit Card available at no charge

- Check access

- 24-hour telephone banking

Peak checking Fees

- No monthly service fee with eStatements

- Paper statements available at $3.00 per statement cycle

True Rewards Checking Features

- Interest earned on balances of $1,000 or more1

- Unlimited checkwriting

- eStatements or paper statements available at no charge

At the time of account opening, elect to have any one of the following rewards at no cost to you if you perform 15 or more signature-based debit card transactions (posted and cleared) each statement cycle:

- Debit card Dime-a-Time cash back2

- Two fee-free non-Northway ATM withdrawals3 per monthly statement cycle

- Two fee-free overdrafts4 per year

- Two free iTunes® downloads per monthly statement cycle5

1Interest rate is variable and subject to change without notice.

2Earn $0.10 cash back for each signature-based debit card transaction paid on the last day of the statement cycle month in which the debit transaction occurs.

3ATM withdrawal made at any ATM in the U.S. that is not owned by Northway Bank. Fee assessed by ATM owner rebated within the statement cycle month of occurrence.

4The two Overdraft Fees (items paid) per year will occur in the same statement cycle in which the corresponding overdraft occurs.

5Maximum value $2.58. Purchases must be made using your Northway Bank debit card to qualify, and must be made and posted in the statement cycle following the cycle in which the reward was earned. Reimbursement will be credited to your account within 60 days of your purchase. iTunes is a registered trademark of Apple Inc.

Convenient ways to access your True Rewards Checking account

- Free Online Banking, Mobile Banking, and Bill Pay

- Northway Debit Card available at no charge

- Check access

- 24-hour telephone banking

True Rewards checking Fees

$5.00 monthly service fee; monthly service fee waived with either of the following:

- Average collected balance of $500 during the statement cycle, or

- If primary account owner maintains $5,000 in combined deposit and loan account balances as follows: average collected balances in checking, savings, money market accounts and club accounts (individually, jointly or trustee), ledger balance in any Certificate of Deposit (individually, jointly or trustee), ledger balance in any IRA account (individually), and ledger balance in any consumer-purpose mortgage, consumer installment and consumer purpose home equity loan(s) and home equity line(s) of credit (individually, jointly or trustee).

TrueNorth relationship Checking Features

- Unlimited check writing

- No ATM fees in the U.S. – fees charged by non-Northway ATMs will be reimbursed1

- Earn competitive interest on every dollar and premium interest for banking electronically2

- Free automatic transfers from a related savings or money market account to avoid overdrafts3

- 50% discount on a Northway Safe Deposit Box4

- Free checks – up to four boxes of TrueNorth Relationship Checking account checks per year5

- eStatements or paper statements at no cost

- Eligibility for a TrueNorth Relationship Money Market Account offering premium rates

1ATM withdrawal made at any ATM in the U.S. that is not owned by Northway Bank. Fee assessed by ATM owner rebated on same posting day as ATM withdrawal transaction at non-Northway ATM.

2A minimum of 15 electronic transactions (Bill Pay, POS, ATM, ACH, deposits made through the Mobile Deposit Application) posted and cleared per statement cycle are required to earn the premium interest rate. Premium interest rates are tiered and variable. Rates are subject to change without notice.

3Overdraft Sweep is a service that automatically moves money from a linked checking, savings, or money market account to cover an overdraft or part of an overdraft, provided the funds are available in the linked account.

4Safe Deposit Boxes subject to availability. Availability may vary by location. Safe Deposit Box contents are not FDIC insured.

5TrueNorth Relationship Checking account checks are available exclusively through Northway Bank.

Convenient ways to access your TrueNorth relationship Checking account

- Free Online Banking, Mobile Banking, and Bill Pay

- Northway Debit Card available at no charge

- Check access

- 24-hour telephone banking

TrueNorth relationship Checking Fees

- $25.00 monthly service fee waived if primary account owner maintains $25,000 in combined deposit and loan account balances as follows: average collected balances in checking, savings, money market accounts and club accounts (individually, jointly or trustee), ledger balance in any Certificate of Deposit (individually, jointly or trustee), ledger balance in any IRA account (individually), and ledger balance in any consumer-purpose mortgage, consumer installment and consumer purpose home equity loan(s) and home equity line(s) of credit (individually, jointly or trustee).

Compare Accounts

| Peak Checking | True Rewards Checking | TrueNorth Relationship Checking | |

|---|---|---|---|

| Minimum Opening | N/A | N/A | N/A |

| Minimum Balance to Avoid Service Charge | N/A | $500∆ | $25,000◊ |

| Monthly Service Charge | No* | $5.00∆ | $25.00◊ |

| Interest Bearing | No | Yes > $1,000 | Yes |

| Free Checks (up to 4 boxes per year) | No | No | Yes |

| No ATM Fees for Non-Northway ATMs | No | No | Yes |

| Safe Deposit Box Discount† | No | No | Yes |

| Unlimited Checkwriting | X | X | X |

| Free Debit Card | X | X | X |

| Overdraft Protection Services Available |

X | X | X |

| Free Online Banking and Bill Pay |

X | X | X |

| Mobile Banking and Mobile Deposit |

X | X | X |

| Dime-a-Time Option Available |

X | X | |

| Statement Options | eStatement* or Paper ($3.00) | eStatement or Paper | eStatement or Paper |

| More > | More > | More > |

∆ If average daily balance of $500 or combined balances of $5,000 in checking, savings, CDs, IRAs, consumer loans, or residential mortgages is maintained there will be no monthly fee, otherwise $5.

◊ If average collected balance of at least $25,000 in any combination of checking, savings, CDs, IRAs, consumer loans, or residential mortgages with Northway is maintained there will be no monthly fee, otherwise $25.

† Safe Deposit Box contents are not FDIC insured.

Reorder Checks

Northway Bank has partnered with the leading check provider, Deluxe, to provide a fast, convenient way to order or reorder checks online. Click the button below and you'll be taken directly to the Deluxe website. To place your order, you will need your Northway Bank checking account and routing number.

Locate Routing Number

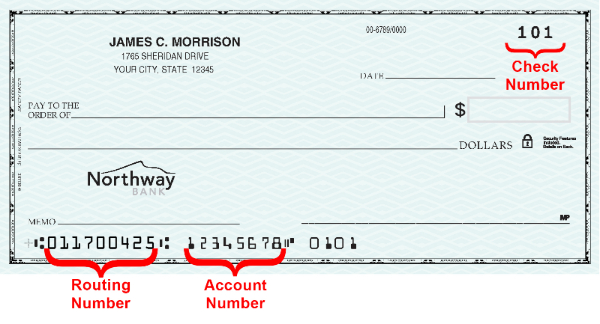

What is Northway Bank's routing number and where can I find it?

A routing number, also known as an ABA number or a routing transit number, is a unique number that identifies a specific bank in certain monetary transactions. It is printed on checks, used when making domestic wire transfers, and used for direct deposit/ACH transactions. Northway Bank’s routing number is listed below.

Northway Bank Routing Number: 011700425

This nine-digit identifier can be seen printed on your checks, to the left of your account number. The image below shows where the routing number appears on a Northway Bank check.

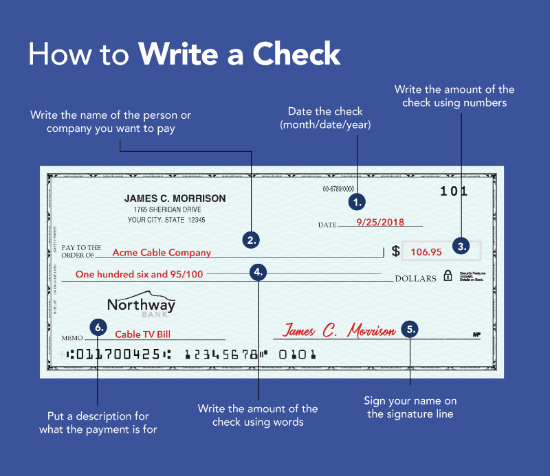

How to Write a Check

- Date the check (month/date/year) with the date you are writing the check.

- Write the name of the person or company you want to pay.

- Write the amount of the check using numbers (show the dollars followed by the cents).

- This line is normally pre-printed with the word “dollars” at the end of the line. Write the dollar amount of the check using words. Cents should follow the dollars and be shown as a fraction in hundredths. Example: 15 cents is 15/100. Put a line through any remaining space available.

- Sign your name using the signature you used when you opened your checking account.

- (optional) If asked to write the invoice number on the check, use the Memo space.

Check writing FAQS

Q: How do I write a dollar amount of $452.00?

A: Four hundred fifty two and no/100.

A: Four hundred fifty two and no/100.

Q: How do I write a dollar amount of $1,350.75?

A: One thousand three hundred fifty and 75/100.

Q: How do I write a dollar amount of $0.75?

A: Zero and 75/100.

Q: Do I use “or” or “and” when writing a check to two payees?

A: A check made payable to Jane Sample or John Sample must only be endorsed by one of the two when presented for payment. A check made payable to Jane Sample and John Sample must be endorsed by both Jane Sample and John Sample before it can be presented for payment.

A: A check made payable to Jane Sample or John Sample must only be endorsed by one of the two when presented for payment. A check made payable to Jane Sample and John Sample must be endorsed by both Jane Sample and John Sample before it can be presented for payment.

Q: How do I write a check for a dollar amount that won’t be available in my checking account until next week?

A: A check should never be issued unless the maker has enough funds in his/her checking account to pay the check. Issuing a future-dated check, also called a “post-dated check”, is never a good idea. Once a check is issued, it can be deposited immediately.

A: A check should never be issued unless the maker has enough funds in his/her checking account to pay the check. Issuing a future-dated check, also called a “post-dated check”, is never a good idea. Once a check is issued, it can be deposited immediately.

Q: What should I do if I make a mistake when writing a check? Can I use white-out on the check?

A: Write VOID in large letters on the face of the check then destroy it. White-out cannot be used to correct an error on a check.

A: Write VOID in large letters on the face of the check then destroy it. White-out cannot be used to correct an error on a check.

Switch Support Forms

- Switch Support - Automatic Payment (PDF 153KB) - Complete this form to have automatic payments paid from your Northway Bank account! Send a copy of the completed form to each creditor that is automatically withdrawing payments from your old account.

- Switch Support - Direct Deposit (PDF 151 KB) - Complete this form and provide it to your employer, or to anyone that you receive direct deposit funds from, to have funds directly deposited to your Northway Bank account!

- Switch Support - Account Closing Letter (PDF 149 KB) - Complete this form and provide it to the financial institution where you have your existing checking account to close your account and transfer the balance to your Northway Bank account!

Customer Service 800-442-6666

24-Hour Telephone Banking 888-568-6310

NMLS #405698