We have created the following Q&A to help provide a clear understanding of how FDIC insurance works. The Q&A and links below are designed to provide you easy access to information about FDIC Insurance and provide you helpful tools to determine how much FDIC insurance your deposit accounts qualify for.

Q: What is FDIC Insurance?

A: FDIC insurance protects bank customers in the event that an FDIC-insured depository institution fails. Bank customers don’t need to purchase or apply for deposit insurance; it is automatic for any deposit account opened at an FDIC-insured bank. Deposits are insured up to at least $250,000 per depositor, per FDIC-insured bank, per ownership category.

A: FDIC insurance protects bank customers in the event that an FDIC-insured depository institution fails. Bank customers don’t need to purchase or apply for deposit insurance; it is automatic for any deposit account opened at an FDIC-insured bank. Deposits are insured up to at least $250,000 per depositor, per FDIC-insured bank, per ownership category.

Q: Are my deposits at Northway Bank FDIC insured?

A: Your deposits at Northway Bank are backed by the FDIC within published FDIC insurance limits. Northway Bank has been FDIC insured since April 16, 1934.

The FDIC is an independent agency created by Congress to maintain stability and public confidence in the Nation’s financial system.

A: Your deposits at Northway Bank are backed by the FDIC within published FDIC insurance limits. Northway Bank has been FDIC insured since April 16, 1934.

The FDIC is an independent agency created by Congress to maintain stability and public confidence in the Nation’s financial system.

Q: Can I have more than $250,000 of deposit insurance coverage at one FDIC-insured bank?

A: Yes. The FDIC insures deposits according to the ownership category in which the funds are insured and how the accounts are titled. The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category as defined by the FDIC.

A: Yes. The FDIC insures deposits according to the ownership category in which the funds are insured and how the accounts are titled. The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category as defined by the FDIC.

Deposits held in different ownership categories are separately insured, up to at least $250,000, even if held at the same bank. Examples of the several FDIC ownership categories can be seen on the following FDIC web page: https://www.fdic.gov/resources/deposit-insurance/financial-products-insured/

Q: Does the FDIC have a brochure that explains FDIC deposit insurance coverage with examples?

A: The FDIC has a free brochure on FDIC insurance coverage that can be found at the following link: Your Insured Deposits (PDF). This brochure provides a comprehensive description of FDIC deposit insurance coverage for the most common account ownership categories. A hardcopy of this brochure can be obtained in any of our branches.

A: The FDIC has a free brochure on FDIC insurance coverage that can be found at the following link: Your Insured Deposits (PDF). This brochure provides a comprehensive description of FDIC deposit insurance coverage for the most common account ownership categories. A hardcopy of this brochure can be obtained in any of our branches.

If you have additional questions about your coverage, or would like to learn more about FDIC insurance and how it works, the FDIC provides the following additional resources:

Q: Are the contents of my Safe Deposit Box FDIC Insured?

A: No, Safe Deposit Box contents are not FDIC Insured. If you would like the contents to be insured, contact your homeowners insurance agent about purchasing a rider for the Safe Deposit Box contents.

A: No, Safe Deposit Box contents are not FDIC Insured. If you would like the contents to be insured, contact your homeowners insurance agent about purchasing a rider for the Safe Deposit Box contents.

Q: How much FDIC deposit insurance coverage do I qualify for?

A: The FDIC has a free online calculator that anyone can use to determine how much FDIC insurance they may qualify for. The tool is the FDIC’s Electronic Deposit Insurance Estimator (EDIE) and can be found at the following link: FDIC Calculators - FDIC’s Electronic Deposit Insurance Estimator (EDIE).

A: The FDIC has a free online calculator that anyone can use to determine how much FDIC insurance they may qualify for. The tool is the FDIC’s Electronic Deposit Insurance Estimator (EDIE) and can be found at the following link: FDIC Calculators - FDIC’s Electronic Deposit Insurance Estimator (EDIE).

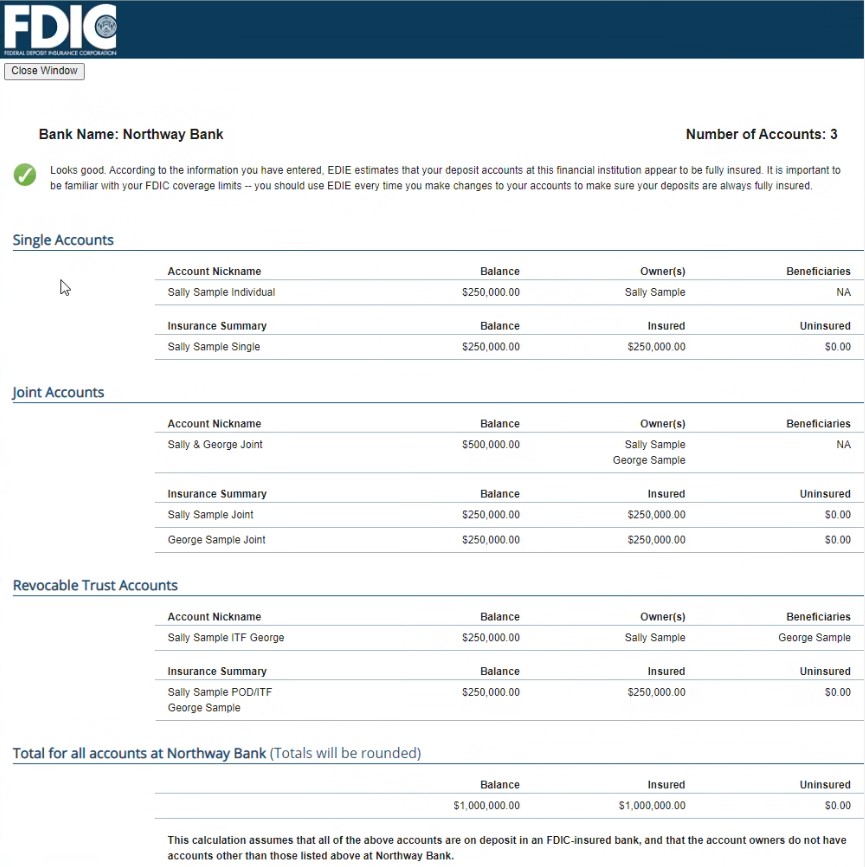

EDIE lets consumers know, on a per-bank basis, how the insurance rules and limits apply to a depositor's specific group of deposit accounts—what's insured and what portion (if any) exceeds coverage limits at that bank. EDIE also allows the user to print the report for their records.

The example below shows an EDIE estimate of FDIC insurance coverage for three deposit accounts for Sally Sample. This particular example shows how Sally Sample can have $1,000,000 or more worth of FDIC insurance coverage at a single FDIC-insured bank based on the account titling and different ownership categories. Depositors are not limited to three; additional accounts are eligible to receive insurance in additional ownership categories.

The three deposit accounts in the example below would pertain to checking accounts, savings accounts (both statement savings and passbook savings), money market accounts, and certificates of deposit held at Northway Bank.

- Sally Sample - Individual with no beneficiaries

- Sally Sample & George Sample - Joint Tenants

- Sally Sample ITF George Sample - revocable trust

Customer Service 800-442-6666

24-Hour Telephone Banking 888-568-6310

NMLS #405698